Business Insurance in and around Altavista

Get your Altavista business covered, right here!

Cover all the bases for your small business

Coverage With State Farm Can Help Your Small Business.

You've put a lot of blood, sweat, and tears into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a cosmetic store, a lawn care service, a window treatment store, or other.

Get your Altavista business covered, right here!

Cover all the bases for your small business

Cover Your Business Assets

You are dedicated to your small business like State Farm is dedicated to great insurance. That's why it only makes sense to check out their coverage offerings for worker’s compensation, commercial liability umbrella policies or surety and fidelity bonds.

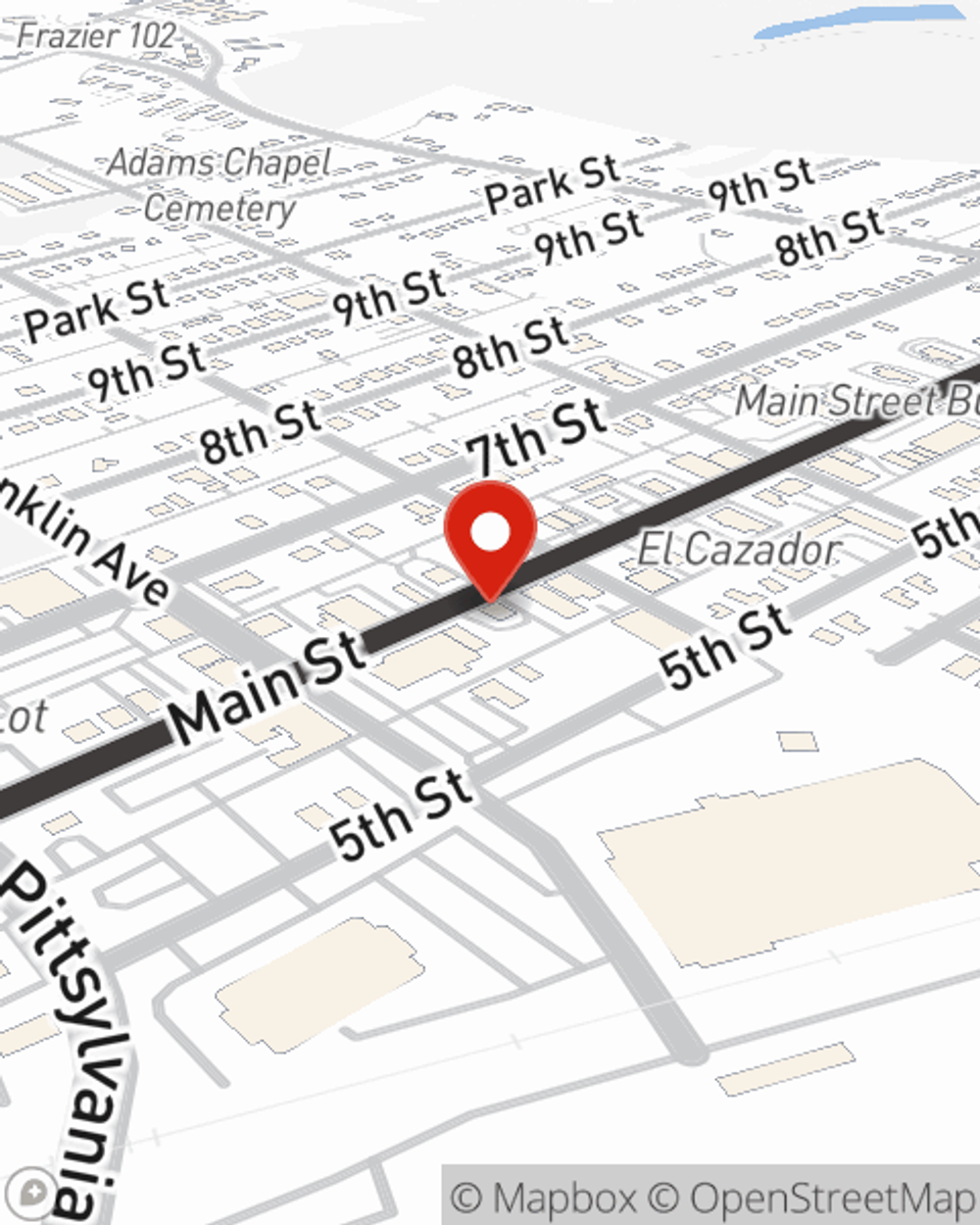

The right coverages can help keep your business safe. Consider contacting State Farm agent Chris Anderson's office today to discover your options and get started!

Simple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Chris Anderson

State Farm® Insurance AgentSimple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.